child tax credit 2021 dates by mail

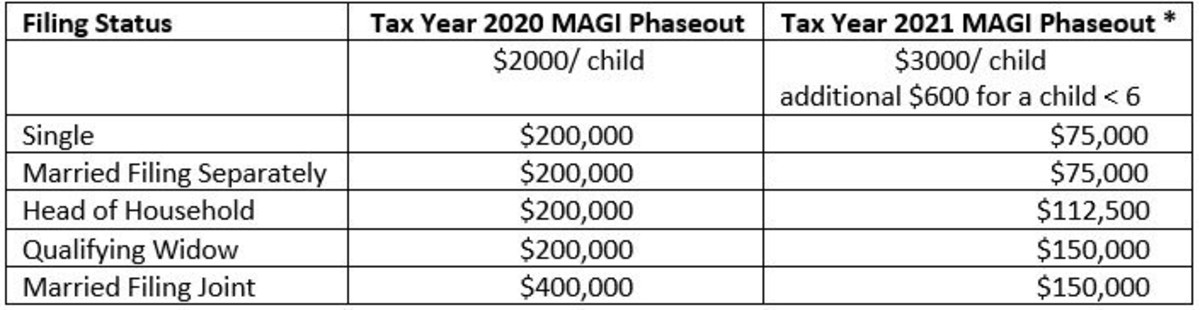

After that payments were phased out by 50 per every 1000 over the income threshold. It also provided monthly payments from July of 2021 to.

Child Tax Credit What You Need To When Filing Your 2021 Taxes Khou Com

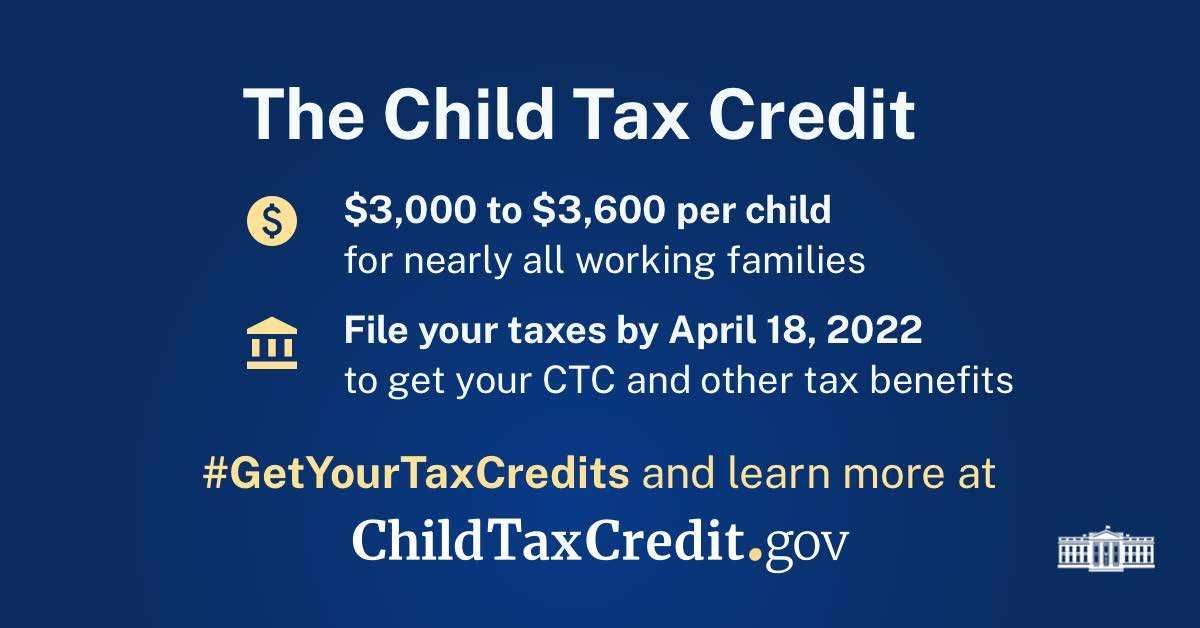

Visit ChildTaxCreditgov for details.

. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. The IRS processes returns with refunds due first because if the agency keeps you waiting too long it has to pay you your refund with interest. Aug 13 2021 156 PM The child tax credit payments are being sent to families every month through December.

Smith Jason R-MO-8 Introduced 01252022. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600. Alexi RosenfeldGetty Images Another monthly child tax credit.

New 2021 Child Tax Credit and advance payment details. You can qualify for the full 2000 child tax credit if your modified adjusted gross income MAGI is below 200000 for single filers. That program part of the 2021 American Rescue Plan Act let families receive up to 3600 per child under the age of 6 and 3000 for children ages 6 to 17.

Canada child benefit CCB Includes related provincial and territorial programs All payment dates January 20 2022 February 18 2022 March 18 2022 April 20 2022 May 20. Child Tax Credit amounts will be different for each family. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300.

600 in December 2020January 2021. Child tax credit 2021 dates by mail Monday April 18 2022 The IRS will pay half the total amount of credit amount in advance monthly payments beginning July 15 2021 and. Your amount changes based on the age of your children.

The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17. Have been a US. HR6505 - Child Tax Credit for Pregnant Moms Act of 2022 117th Congress 2021-2022 Bill Hide Overview.

A In general Section 24 of the Internal Revenue Code of 1986 is amended by adding at the end the following new subsection. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. L Credit allowed with respect to unborn.

For joint filers its 400000. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. Child tax credit 2021 dates by mail Wednesday August 17 2022 Edit See what makes us different.

The IRS has 45 days to process. 1200 in April 2020. Now Bidens relief bill will temporarily increase the tax credit to 3000 for eligible.

Your amount changes based on the age of your. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible.

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Child Tax Credit 2021 Payments How To Know If You Owe Irs Letter To Watch For

Child Tax Credit 2021 Here S When The Fifth Check Will Deposit Cbs News

American Rescue Plan Act Of 2021 And Divorce Planning Child Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

The Child Tax Credit Newsroom News Events Community Action Partnership Of Utah

Tools To Unenroll Add Children Check Eligibility Child Tax Credit

Three More Advanced Child Tax Credit Payments To Hit Accounts Wfmynews2 Com

If You Got The 2021 Child Tax Credit Watch For This Letter

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com

Advanced Child Tax Credit Recipients The Irs Will Send A Letter

Child Tax Credit Update What Is Irs Letter 6419

2021 Advanced Child Tax Credit What It Means For Your Family

How To Get The Child Tax Credit If You Have A Baby In 2021 Money

Irs Urges Parents To Watch For New Form As Tax Season Begins

Newsletter Monthly Payments Are On The Way To Hardworking Maryland Families Congressman Steny Hoyer

Child Tax Credit Update A Portal To Update Bank Details And Facilitate Payments Marca

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc